Equifax Litigation

Yearout & Traylor was one of the first firms to file a Class Action (Alabama) against Equifax as a result of the massive data breach seeking national class status. You can access a copy of the complaint here. We have sued for the breach, under the Fair Credit Reporting Act, among other claims asserted or to be asserted.

Our complaint seeks class certification to represent all individuals on a national basis who were impacted by the Equifax data breach. You can read some about the lawsuit here: Alabama lawyers seek to represent victims of Equifax hack.

The cases are in their infancy and new cases are being filed daily, including lawsuits threatened (or filed) by several state attorney generals. We hope, through this litigation, to find out who was impacted, the severity of the impact, prevent (or limit) future problems, and importantly discover not only how Equifax permitted this data breach to proceed unnoticed for months, but also failed to promptly notify consumers (and the public) about the breach so that measures could be taken to protect the impacted individuals.

A series of FAQs are below and we hope to add to this list as we receive common questions and learn more information. We will try to use this site, among other resources, to keep you up to date about the progress of the litigation. If you want our help, please let us know by signing up with our firm: Equifax Data Breach Form. If you have any questions, please let us know.

FAQs

How do I find out if my data is breached?

You can find out if your data was possibly breached by visiting this site. We expect you to receive one of three responses once you provide the necessary information:

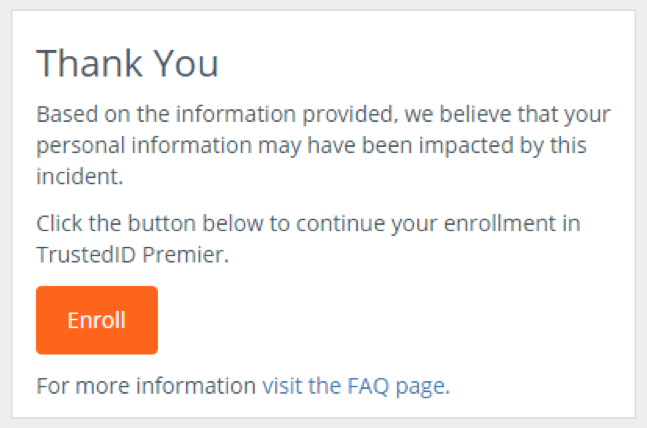

You may have been breached:

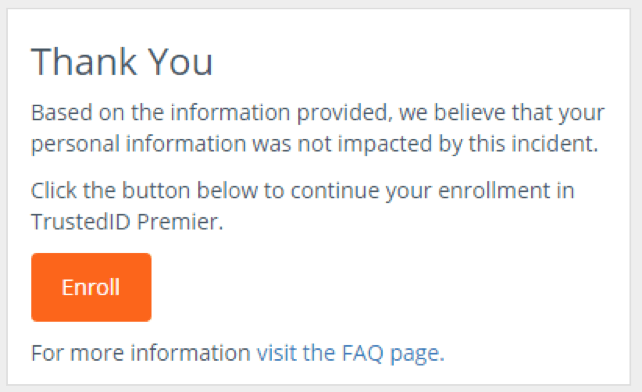

You have not been breached:

Check back on [DATE]:

At least one person has responded that he/she will need to check back on a certain date. If you receive that response, check back, but in the interim, we still encourage you to sign up since we will not be filing new claims right away and we can keep you in the loop and watch your claim while we figure out exactly who has been impacted.

We ask that you DO NOT ENROLL in Equifax’s program at this time given the uncertainty about how that might impact your claim. But we do have some recommendations for you below.

My data was breached (or may have been). What do I do?

First, we recommend that you fill out the Equifax Data Breach Form and sign up with us so that we can represent you in the Equifax Litigation.

You can read a little about the lawsuit that we filed here.

There are several steps you can take to protect your credit now. Unfortunately for some, these would have been much more helpful had Equifax not been slow to respond and report the massive data breach.

You should also pass this information along to family and friends so that they can take steps to protect themselves and protect their rights.

What do I do to protect my credit?

- Freeze your credit file with all three major credit reporting agencies (Equifax, Experian, & Transunion). When you freeze your credit, only those financial institutions that you already have credit with can extend additional credit while the credit is frozen. If you currently seeking credit or intend to seek credit, you will need to remove the freeze for any creditor that does not have a pre-existing relationship with you.

- Place a Fraud Alert on your credit file. A fraud alert is free and will make it harder for thieves to steal your credit. The creditor must take extra steps to verify your identity before issuing credit in your name. You will need to renew the fraud alert every 90 days.

Here is how to set up a Fraud Alert on your credit files:

- Report to the Credit Reporting Agency (“CRA”) that you are a victim of identity theft.

- Request a Fraud Alert on your file.

- Confirm that all the CRA will notify the other two CRAs.

- Set a reminder to renew shortly before the expiration of 90 days.

- Maintain copies of all documents created or received as a result of the placement of a fraud alert.

- Credit Protection – there are several credit protection (ID Theft) sites that will monitor your credit. While we do not recommend Equifax’s plan, there are others that we can suggest (based on Tom’s Guide):

- LifeLock

- IdentifyForce

- IdentifyGuard

The prices can vary depending on the level and provider so please check with each and determine which one meets your needs best.

- Get Your Credit Report – annualcreditreport.com. You can get one free credit report every 12 months. But if you have already received your one free one, we still strongly encourage you to purchase a copy at this time.

- First, access your report at going through the process for each Credit Reporting Agency

- Once you access your report, first save each report as a pdf or print it.

- Once saved, review the contents to see if there is any questionable or fraudulent activity and keep track of that activity.

- Let us know what activity you question so that we can help you file the necessary disputes to get your credit cleared up.

Why should I sign up with you?

Yearout & Traylor has put together a formidable team of lawyers with a variety of backgrounds who will be able to represent the Class of people who have been affected by Equifax’s massive data breach. We have lawyers that focus their practice on litigation and that includes litigation against Equifax, federal questions, the Fair Credit Reporting Act, Identity Theft, and Consumer Protection, among others.

We can help you, your family, and your friends protect their credit, fix their credit, and make a recovery against Equifax. Fill out the Equifax Data Breach Form now.

If you want more information about this team, please let us know.

What happens once I sign up?

Yearout & Traylor will proceed with its class action, monitor other class actions, and pursue your claim against Equifax. While we will pursue your claim, we may not immediately file an action on your behalf while the Class Action complaints are sorted out. Many lawyers from many states have already filed lawsuits against Equifax over the data breach, but no class has been certified yet (09.13.2017).

There are several possibilities:

- National Class Action

- Statewide Class Actions

- Multi-District Litigation (“MDL”) – there is already MDL activity in the case. That is not determinative and things could change. This was an expected initial development.

- Individual Actions

- Because the Class Actions fail or

- Through Opt-Out.

We will learn more as the many cases proceed through the initial stages of litigation in federal district courts.

What are some of the options for how this case proceeds? (Class, MDL, Opt-out)?

- National Class Action

- Statewide Class Actions

- MDL

- Individual Actions

I’ve Signed up. What’s next?

Yearout & Traylor will proceed with its class action, monitor other class actions, and pursue your claim against Equifax. As those cases proceed, we will provide periodic updates through updates on our website, email newsletters, direct letters, and/or phone calls. Depending on how quickly the cases proceed, will depend on how frequently we provide an update.

Keep in mind, standard litigation can last 12-18 months from the moment the case is filed until conclusion. More complex cases can last even longer. Given the breadth and complexity of this massive data breach, it could last several years. But do not be discouraged, we will be there with you every step of the way, keeping track of your claim, your deadlines, and making sure we maximize your recovery as a class member.

What to expect from this litigation

This may be difficult to predict given how early in the litigation we are and what limited information we have how specifically each person was impacted, the total number of people impacted, how people may be impacted in the future, and what can be done to limit the future impact. But we hope to obtain the following:

- Injunctive relief – increase security and protections

- ID Protection – possibly including third party providers outside Equifax’s service.

- Money – the cash component is very difficult to evaluate at this stage. Once we have more information, we will hopefully be in a better position to assess this component.

If I need information, who do I call?

We will have several ways for you to get in touch with us, including:

- Jason L. Yearout – jyearout@yearout.net

- Jacquie Harris (main point of contact) – jharris@yearout.net

- General – info@yearout.net

Phone

- Jason L. Yearout – 205-414-8169

- Jacquie Harris – 205-414-8166

Main

Fax

- Jason L. Yearout – 205-795-7169

- Jacquie Harris – 205-795-7166

- Main – 205-414-8199

We will also send out information through email blasts. You can always unsubscribe to those emails, but we anticipate that will be an important communication tool and will not be abused – we will not flood your inbox.

Office Address

Powered by

Website Disclaimer Privacy Policy

Offices in Birmingham and proudly serving Jefferson County, Central Alabama, North Alabama, Montgomery, Bessemer, Jasper, Talladega & Tuscaloosa.